Weekly Market Commentary 01-19-2021

January 19, 2021

The Markets

Investors were rocked by economic data showing the economy hit the brakes hard in December.

Last week, major U.S. stock indices decelerated as investors gaped at the economic damage caused by the rising number of coronavirus cases around the world. There have been more than two million COVID-19 deaths globally, with more than 390,000 deaths in the United States. The spread has resulted in new lockdowns and restrictions and has hurt the economic recovery.

Ben Levisohn of Barron’s reported:

“This past week – with the market looking ahead to the inauguration and what might be in store following the Capitol riots and Donald Trump’s second impeachment – was a terrible one for economic data. Whether it was small-business confidence, consumer inflation, or just about anything else, the numbers painted a picture of an economy that was slowing more rapidly than expected. Initial jobless claims, which spiked to their highest level since August, and retail sales, which fell 0.7 percent, were particularly frightening.”

On Thursday, President-elect Biden explained his $1.9 trillion economic relief package. The announcement of new stimulus didn’t move investors. That may be because the potential impact of a new stimulus plan has already been priced into markets, as has the new administration’s longer-term plans for infrastructure spending, reported Katherine Greifeld of Bloomberg. The relief package that passes Congress may be smaller – about $1.1 trillion, according to a Goldman Sachs economist cited by Randall Forsyth of Barron’s.

Investors are keeping an eye on inflation, which remains relatively low but has begun trending higher, according to Jeffry Bartash of MarketWatch. During the past few months, the core rate of inflation has remained below the Federal Reserve’s 2 percent target. However, inflation expectations and bond yields have been moving higher, reported Jonnelle Marte, Ann Saphir, and Howard Schneider of Reuters. As bonds provide more attractive returns, income investors may shift away from stocks and into less risky opportunities.

Last week, the Standard & Poor’s 500 Index lost more than 1 percent for the first time since October.

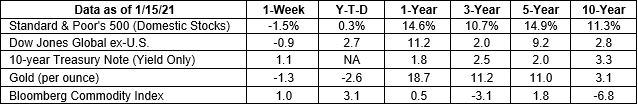

S&P 500, Dow Jones Global ex-US, Gold, Bloomberg Commodity Index returns exclude reinvested dividends (gold does not pay a dividend) and the three-, five-, and 10-year returns are annualized; and the 10-year Treasury Note is simply the yield at the close of the day on each of the historical time periods.

Sources: Yahoo! Finance, MarketWatch, djindexes.com, London Bullion Market Association.

Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly. N/A means not applicable.

Trading teeth for treasure during the pandemic.

Around the globe, the pandemic helped make 2020 one of the most challenging years ever for dentists. The Dental Tribune reported most dental offices around the world closed their doors in March. While most eventually reopened, the impact on dental practices and suppliers was significant. Many adopted cost-cutting measures.

The Tooth Fairy did not suffer the same fate.

In August 2020, Delta Dental’s Original Tooth Fairy Poll® found, “…the Tooth Fairy’s average cash gift increased 30 cents for a lost tooth, for a total of $4.03 per tooth.” The value of a lost tooth has tripled since the poll began in 1998. (The Tooth Fairy exchange rate was about $1.30/tooth back then.)

Four dollars may seem steep, but the United States isn’t the only country where lost teeth command a high price. For example:

- Japanese children receive ¥437.93 from the Tooth Fairy. That’s about $4.22.

- In Ireland and Spain, a baby tooth is worth €3.64 or $4.41.

- Canadian kids receive $5.36 Canadian or $4.38 American.

- Brazilian parents get off lighter. A tooth there is valued at R$17.12 or $3.27.

Visits from the Tooth Fairy offer teachable moments – times when kids may be interested in learning about money. One way to get the discussion going is to ask recipients of the Tooth Fairy’s generosity how they plan to spend the money. Once you’ve listened to the answer, you may want to offer other ideas like saving or donating part of the money. If you would like more ideas, let us know.

Weekly Focus – Think About It

“Inflation is when you pay fifteen dollars for the ten-dollar haircut you used to get for five dollars when you had hair.” --Sam Ewing, Baseball player

Securities offered through LPL Financial, Member FINRA/SIPC.

* These views are those of Carson Coaching, and not the presenting Representative, the Representative’s Broker/Dealer, or Registered Investment Advisor, and should not be construed as investment advice.

* This newsletter was prepared by Carson Coaching. Carson Coaching is not affiliated with the named firm or broker/dealer.

* Government bonds and Treasury Bills are guaranteed by the U.S. government as to the timely payment of principal and interest and, if held to maturity, offer a fixed rate of return and fixed principal value. However, the value of fund shares is not guaranteed and will fluctuate.

* Corporate bonds are considered higher risk than government bonds but normally offer a higher yield and are subject to market, interest rate, and credit risk as well as additional risks based on the quality of issuer coupon rate, price, yield, maturity, and redemption features.

* The Standard & Poor's 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. You cannot invest directly in this index.

* All indexes referenced are unmanaged. The volatility of indexes could be materially different from that of a client’s portfolio. Unmanaged index returns do not reflect fees, expenses, or sales charges. Index performance is not indicative of the performance of any investment. You cannot invest directly in an index.

* The Dow Jones Global ex-U.S. Index covers approximately 95% of the market capitalization of the 45 developed and emerging countries included in the Index.

* The 10-year Treasury Note represents debt owed by the United States Treasury to the public. Since the U.S. Government is seen as a risk-free borrower, investors use the 10-year Treasury Note as a benchmark for the long-term bond market.

* Gold represents the afternoon gold price as reported by the London Bullion Market Association. The gold price is set twice daily by the London Gold Fixing Company at 10:30 and 15:00 and is expressed in U.S. dollars per fine troy ounce.

* The Bloomberg Commodity Index is designed to be a highly liquid and diversified benchmark for the commodity futures market. The Index is composed of futures contracts on 19 physical commodities and was launched on July 14, 1998.

* The DJ Equity All REIT Total Return Index measures the total return performance of the equity subcategory of the Real Estate Investment Trust (REIT) industry as calculated by Dow Jones.

* The Dow Jones Industrial Average (DJIA), commonly known as “The Dow,” is an index representing 30 stock of companies maintained and reviewed by the editors of The Wall Street Journal.

* The NASDAQ Composite is an unmanaged index of securities traded on the NASDAQ system.

* International investing involves special risks such as currency fluctuation and political instability and may not be suitable for all investors. These risks are often heightened for investments in emerging markets.

* Yahoo! Finance is the source for any reference to the performance of an index between two specific periods.

* The risk of loss in trading commodities and futures can be substantial. You should therefore carefully consider whether such trading is suitable for you in light of your financial condition. The high degree of leverage is often obtainable in commodity trading and can work against you as well as for you. The use of leverage can lead to large losses as well as gains.

* Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

* Economic forecasts set forth may not develop as predicted and there can be no guarantee that strategies promoted will be successful.

* Past performance does not guarantee future results. Investing involves risk, including loss of principal.

* The foregoing information has been obtained from sources considered to be reliable, but we do not guarantee it is accurate or complete.

* There is no guarantee a diversified portfolio will enhance overall returns or outperform a non-diversified portfolio. Diversification does not protect against market risk.

* Asset allocation does not ensure a profit or protect against a loss.

* Consult your financial professional before making any investment decision.

Sources:

https://coronavirus.jhu.edu/map.html (or go to https://resources.carsongroup.com/hubfs/WMC-Source/2021/01-19-21_JohnsHopkinsUniversity-COVID-19_Dashboard_Map-Footnote_1.pdf)

https://www.barrons.com/articles/the-stock-market-fell-the-most-since-october-why-big-tech-is-part-of-the-problem-51610759892?refsec=the-trader (or go to https://resources.carsongroup.com/hubfs/WMC-Source/2021/01-19-21_Barrons-Fear_Comes_to_the_Stock_Market-What_Comes_Next-Footnote_2.pdf)

https://www.bloomberg.com/news/articles/2021-01-14/u-s-stocks-hold-steady-afterhours-on-biden-aid-deal-proposal (or go to https://resources.carsongroup.com/hubfs/WMC-Source/2021/01-19-21_Bloomberg-US_Stock_Futures_Decline_After_Bidens_Spending-Bill_Proposal-Footnote_3.pdf)

https://www.barrons.com/articles/as-u-s-fights-todays-problems-tomorrows-inflation-starts-to-stir-51610762538 (or go to https://resources.carsongroup.com/hubfs/WMC-Source/2021/01-19-21_Barrons-As_US_Fights_Todays_Problems_Tomorrows_Inflation_Starts_to_Stir-Footnote_4.pdf)

https://www.marketwatch.com/story/consumer-inflation-climbs-0-4-in-decem...

https://www.reuters.com/article/us-usa-fed/fed-sees-rising-bond-yields-i...

https://am.dental-tribune.com/news/weighing-up-the-new-reality-dental-co...

https://www.deltadental.com/us/en/tooth-fairy/press-release.html

https://www.deltadental.com/us/en/tooth-fairy/the-original-poll.html

https://www1.oanda.com/currency/converter/ (or go to https://resources.carsongroup.com/hubfs/WMC-Source/2021/01-19-21_OANDA-Currency_Converter-Footnote_10.pdf)