On July 4, 2025, the One Big Beautiful Bill Act (OBBBA) was signed into law. This sweeping legislative package combines permanent tax reforms, new deductions

I remember when multi-factor strategies became popular 15 years ago. They were marketed to add more diversification than the market while capturing the known

My spouse, Jorvany, and I have two dogs: Max, a Terrier mix, and Nani, a Chihuahua. On July 4th, Jorvany left for a month-long trip to visit his family in

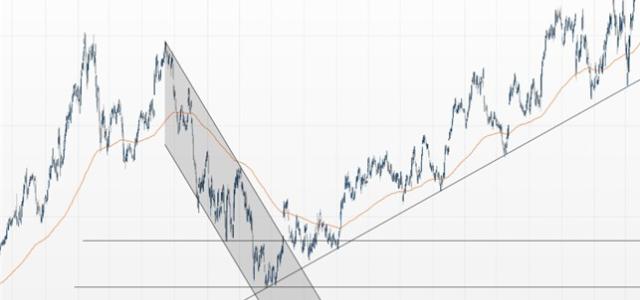

What a whirlwind were the first two quarters of the year!

If we simply looked at year-to-date returns, it would seem like a pretty normal year. Up 6% for the S&P

When people hear the term estate planning, many assume it’s something only the wealthy need to worry about. In reality, estate planning is an essential part of

A business owner's mindset is often focused on long-term survival. Yet, according to the U.S. Bureau of Labor Statistics, only 25% of new businesses survive 15

The Markets

Employment was top of mind for financial markets last week.

Economists and investors hoped May employment information would provide insight to the

The Markets

Consumers were feeling cautiously optimistic.

When people talk about the United States economy, they’re usually referring to gross domestic product

What if there was a way to set aside money, watch it grow tax-free, and spend it tax-free - all while saving on your healthcare costs? That’s exactly what a

Years ago, while visiting investment managers in Manhattan, I had an interesting experience. I went from a reputable value manager from one side of the street

Disability Insurance is insurance for your income if you become disabled and not able to work. Most people have the coverage through their work in the form of

The Markets

Nobody likes to balance the budget.

Some pundits said Moody’s rating downgrade of U.S. Treasuries was a nothing burger. After all, the rating change